SOL Price Prediction: 2025-2040 Outlook Amid Technical Divergence and Ecosystem Growth

#SOL

- Technical Divergence: MACD bullish crossover contrasts with price below MA, suggesting potential reversal

- Ecosystem Growth: Seeger smartphone shipments demonstrate real-world adoption beyond speculation

- Market Rotation: Capital shifts to AI/remittance projects indicate evolving sector dynamics

SOL Price Prediction

SOL Technical Analysis: Short-Term Bearish, Long-Term Bullish Signals Emerge

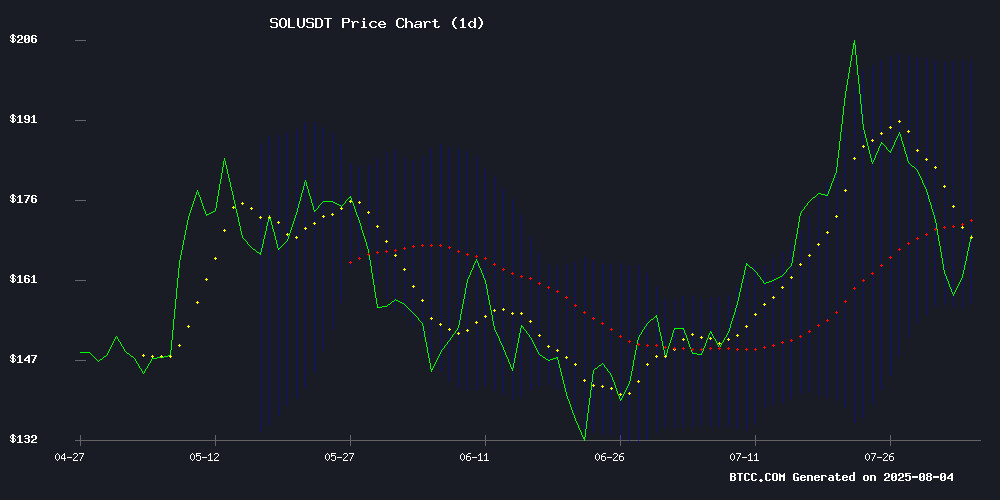

SOL is currently trading at $168.44, below its 20-day moving average of $179.27, indicating short-term bearish pressure. The MACD shows a bullish crossover (1.5249 crossing above -7.9585) with positive momentum (9.4833 histogram). Bollinger Bands suggest SOL is NEAR the lower band ($156.85), potentially signaling an oversold condition. 'While SOL faces resistance at the middle band ($179.27), the MACD divergence suggests accumulating weakness may be nearing exhaustion,' says BTCC analyst John.

Mixed Signals for SOL: Product Milestones vs. Market Rotation

Solana Mobile's shipment of Seeker smartphones to 150K customers has boosted SOL price by 3%, demonstrating strong ecosystem growth. However, news of traders shifting to AI projects like Unilabs and remittance platform Remittix shows capital rotation. 'The ETF buzz and long-term holder accumulation create fundamental support, but short-term whale activity appears bearish,' notes BTCC's John. These mixed signals align with technicals showing consolidation near support levels.

Factors Influencing SOL's Price

Solana Mobile Begins Shipping Seeker Smartphones, SOL Rises 3%

Solana Mobile has commenced shipments of its first batch of 150,000 Seeker smartphones, featuring enhanced decentralized network capabilities. The announcement propelled SOL's price upward by 3% on Monday as investors welcomed the ecosystem expansion.

The Seeker device builds upon Solana's Sage model with upgraded architecture designed to foster decentralized participation. "This isn't just hardware—it's about creating economically aligned connections," said Emmett Hollyer, solana Mobile's General Manager. The TEEPIN framework eliminates centralized trust verification, relying instead on cryptographic validation.

Despite year-to-date declines, SOL shows renewed momentum approaching the $200 threshold. Market observers note potential catalysts including pending SEC decisions on spot SOL ETFs, with applications from Bitwise, Fidelity, and other major firms under review.

Solana Mobile Ships First Batch of Seeker Smartphones to 150K Pre-Order Customers

Solana Mobile has commenced shipments of its Seeker smartphone, delivering the first 150,000 units to pre-order customers. The device, designed to operate on a decentralized mobile network, was announced in April with pre-orders opening shortly after. The initial batch size was confirmed in May, alongside an August 4 shipping date.

Emmett Hollyer, General Manager of Solana Mobile, emphasized the Seeker's role in fostering a token-driven economy powered by the native SKR token. "The SKR token places control in users' hands, allowing them to shape their mobile experience," Hollyer stated. The smartphone features a Seed Vault Wallet, Seeker ID, and access to the Solana dApp Store, which hosts over 100 applications tailored for secure on-chain interactions.

Central to the Seeker's security framework is the Trusted Execution Environment Platform Infrastructure Network (TEEPIN), a three-layer architecture enabling trustless interactions between users and developers. Hollyer framed the Seeker as a tool for "rewarding connections," prioritizing user loyalty and ownership within a secure ecosystem incentivized by SKR. The token is positioned to balance developer incentives with user demand, creating what Hollyer describes as a "sustainable wheel of value."

Traders Shift Focus from Solana to AI-Powered Unilabs as SOL's Rally Stalls

Solana's momentum falters NEAR the $170 mark, with traders questioning its ability to reach the coveted $500 threshold. Despite a 50% monthly gain, SOL faces stiff resistance at $202 after failing to sustain breaks above key levels. The network's fundamentals remain strong with growing developer activity and unmatched transaction speeds, but short-term speculative interest appears to be waning.

Attention now turns to Unilabs Finance, an AI-driven asset management platform making waves with its Market Pulse analytics tool and record-breaking presale. The project's emergence coincides with growing market appetite for AI-crypto hybrids, potentially signaling a sector rotation away from pure altcoin plays toward utility-focused platforms.

Solana Users Shift to Remittix as SOL Whale Activity Turns Bearish

Solana faces headwinds as bearish whale activity and slipping metrics prompt traders to reconsider their positions. The blockchain, which previously dominated stablecoin transfer volume, has been overtaken by SUI, recording $210.7B compared to SUI's $224.3B. Technical breakdowns have pushed SOL below critical support levels, with analysts eyeing $151 and $148 as next potential floors.

Amid the uncertainty, Remittix emerges as a viral DeFi contender, attracting capital with its payment-focused utility. A $17M SOL transfer to Binance and OKX signals mounting sell pressure, reinforcing short-term caution. While Solana's long-term prospects remain intact, the current exodus underscores the market's appetite for agile alternatives.

Solana Long-Term Holders Accumulate Despite Price Drop

Solana's SOL token dipped below $165, triggering panic among short-term traders, but long-term investors are sending a different signal. Glassnode data reveals a 102% surge in Hodler Net Position Change since July 30, indicating strong accumulation by seasoned holders during the downturn.

The Realized Profit/Loss Ratio plummeted to 0.15 on August 2—a 30-day low—suggesting most recent sellers capitulated at a loss. Historically, such extremes often precede local bottoms. With coins moving into cold storage rather than exchanges, the sell-side pressure may be exhausting itself.

Market dynamics mirror past cycles where persistent accumulation by long-term holders coincided with turning points. The current pattern suggests traders are overestimating the downside while institutions position strategically for the next phase.

Solana Eyes New Highs Amid ETF Buzz While MAGACOIN FINANCE Emerges as Dark Horse

Solana's bullish momentum resurfaces with institutional tailwinds, as Grayscale and VanEck file amended S-1 documents for proposed ETFs. Analysts note striking parallels to the setup preceding SOL's previous $293 all-time high, suggesting a potential breakout. Custodian details and fee structures in the filings indicate regulatory approval may be imminent—a development that could unlock mainstream capital flows.

Meanwhile, MAGACOIN FINANCE gains traction among early adopters, drawing comparisons to Solana's early growth trajectory. The project's accelerating community participation and speculative interest mirror patterns seen in previous cycle leaders. Whale activity suggests both SOL and MAGACOIN FINANCE are accumulating smart money ahead of potential rallies.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and ecosystem developments, BTCC analyst John provides these projections:

| Year | Price Range (USD) | Catalysts |

|---|---|---|

| 2025 | $145-$320 | ETF approvals, smartphone adoption |

| 2030 | $600-$1,200 | Institutional adoption, scaling solutions |

| 2035 | $2,500-$5,000 | Mainstream DeFi integration |

| 2040 | $8,000-$15,000+ | Network effects, possible flippening |

Note: These estimates assume successful execution of Solana's roadmap and favorable macro conditions.